By Linda Schmid

Many different economic indicators can be taken into account when looking for clues as to what the state of the industry is likely to be just a short distance down the road. One check is what the experts in a given industry see. Shield Wall Media, parent company of Rural Builder magazine, did a survey in conjunction with METALCON to measure the climate in the construction industry. The results are overwhelmingly positive; the majority of builders improved sales and profitability in 2022. Further, most believe that their business will not only sell more or about the same in 2023 as they did in 2022, but they project their overall profitability to be the same or better. (For further insights from our survey, see the Construction Survey Insights on page 51).

A look at industry behavior can be a great indicator of where things are headed. According to Sean Shields, Director of Communications of the Structural Building Components Association (SBCA), the Business Components Manufacturers Conference (BCMC) 2022 was the most well-attended since 2006. There were twelve education sessions full of people eager to pick up new ideas including panel discussions that fostered a vibrant exchange of ideas. Attendance was up from 742 in 2021 to 1,216 this year, exhibiting a great enthusiasm and willingness on the part of owners to spend money to better their businesses. That’s a very good sign for the economy.

Ben Johnston, Chief Operating Officer at Kapitus, a finance provider for small and medium sized businesses observed that financing applications were up in 2022, 34% up year over year with the funded volume up 46% to approximately $230 million. This of course speaks to the state of the industry last year when demand – and inflation – were both high. Contractors worked through spiking material costs, labor shortages, and supply chain issues.

Navigation in 2023

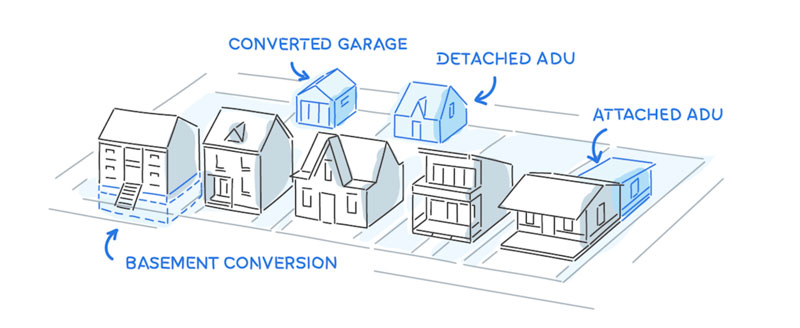

Going into 2023, Johnston expects rising interest rates to depress both residential construction as well as low-rise commercial projects. However, he believes that as demand for new construction slows, many people will be investing in renovating the homes and business buildings they already own rather than trading up.

Zonda Media, however, is forecasting a drop in residential remodeling in 2023, and, in fact, continuing in a more limited way through 2024. Not only has there been a slowdown in existing home sales in 2022, but home prices are expected to decrease in every state in 2023, a correction in the market. This can lead to fewer home projects meant to increase value for sale or projects new homeowners instigate to make a newly purchased home theirs. Projections of declines in real incomes are also expected. All of this leads Zonda to conclude that remodeling will be down approximately 2.3% by the end of the year, mainly in the more moderate homes of lower income homeowners. However, the home improvement industry has some mitigating factors on its side, such as high levels of homeowner equity and savings. Also, many new homes were built in the early 2000s that are due for renovations and repairs.

On the other hand, Mike Collins, economist and Managing Principal at EquiNova Capital Partners predicted a 7 percent growth in residential remodeling.

“Homeowners have made the decision to stay put and throw money into remodeling, and they are willing to pay to have things just the way they want in what is a long-term investment for them,” Collins said. “They have low interest rate mortgages, so they are not buying right now.”

Businesswire offered positive predictions for the shed industry. They state that “the Europe & US outdoor shed market is expected to grow from US$ 2,816.93 million in 2021 to US$ 3,868.74 million by 2028.” This assessment comes from taking the long view of the case.

The COVID-19 outbreak initiated greater interest in sheds as people looked for extra space while they worked from home. Many turned to gardening as other, more public, activities were not possible, thus requiring storage for equipment and supplies.

Industry, including automotive and the construction sector itself, is seeing increasing need for storage space, perhaps in part because people are trying to keep more inventory on hand, but also for equipment, tools, and workshops. They want long-lasting, environment-resistant sheds so the demand is largely for metal sheds. As this demand increased, so did the price of raw materials such as steel. However, industry sees storage as a necessity and many homeowners have increasing disposable income and are willing to pay for what they want.

Industry Experts Weigh In

Jeff Yelle, Vice President, Chief Information Officer and Tom Hanzely, Senior Marketing Manager-Growth & Innovation, Siding at LP Building Solutions see sunny skies on the horizon.

Yelle said, “The underlying demand for housing remains strong, so…we expect the industry to continue investing in growth, new innovations and operational excellence.”

Hanzely said that the “unprecedented labor and economic conditions” will cause companies to adapt or refocus. He believes that labor-saving and time-reducing products are the way to go.

“I believe it’s a wonderful time to refine our approach to building better structures from the perspective of quality, performance, function and sustainability,” Hanzely stated.

Rob Haddock, CEO of S-5! believes what many economists have been saying, that the U.S. economy is likely going into a slowdown, if not a recession. He explains that the huge building boom that everyone has experienced is largely the product of the COVID-19 crisis and the supply shortages. The industry has been basically playing catch-up all through 2022. With demand up and supplies down, prices inevitably rose. Then inflation was added in. Haddock thinks these factors will likely bring demand down as we move through the first quarter of 2023. Then the industry will slow — noticeably — but not necessarily catastrophically. On the up side, this may help with the labor shortage.

Keith Dietzen, CEO of Keymark agrees that rising interest rates and tightening credit will have a bit of a dampening effect in the new year. As someone who studied economics, he said that the two key factors he watches are inflation and interest rates. If inflation doesn’t start coming down, the Federal Reserve will raise interest rates to try and bring supply and demand into balance. But, when rates rise, it impacts new construction and other capital expenditures and it can reduce demand throughout the economy. Still, he’s not convinced it will be a very dramatic slowing of the economy.

However, he has advice for businesses should there be more than a slight downturn.

“It’s a mistake to cut back too much, especially in your marketing budget. When the industry gets soft, that’s when you really need to get aggressive on the marketing end, getting people into your shop by advertising and at trade shows. That’s when you gotta market your products and services and find new customers.”

Not everyone agrees with these assessments. Christian Rios, Marketing Manager and Mike O’Hara, National Sales Manager at Levi’s Building Components foresee good things coming in 2023. They believe commercial construction particularly and construction overall will be strong. They speak to the slowly declining prices of lumber and steel as promising indicators, though they acknowledge that concrete, insulation, and some other material prices continue to rise.

Haddock also sees some prices going down and believes that material prices will stabilize eventually, once the demand calms down. He has already seen the cost of aluminum level and even decline as well as steel leveling out.

Not everyone is as optimistic about material prices. Amanda Storer, Director of Marketing at Metl-Span/Centria of the Nucor Insulated Panel Group said, “We foresee a gradual decline in projects, specifically towards the back half of ‘23 because of the continued rise in interest rates and higher than historical raw material costs.”

A sign Rios and O’Hara hail as good news in their own section of the industry is the continuing migration to the southern states, where they say awareness of the benefits of metal roofing is growing, promising great market growth.

Wayne Troyer of Acu-Form has seen that metal roofing and siding are gaining market share as more people begin to think long-term. He does see some serious challenges ahead though: interest rates and fuel prices. He believes that due to higher interest rates people are more likely to just hold on to the buildings they have instead of building or buying.

On the bright side, Troyer has a plan. He intends to partner with his customers, ensuring that his pricing is mutually profitable. Further, he thinks that the end user hasn’t felt the impact of the material prices that have dropped much yet, so once they do it should get things moving.

What Can “Trends” Do For You?

Dietzen has noticed a positive trend in the post-frame industry. Interest in barndominiums has been growing.

“It’s an interesting phenomenon,” he says, “because it’s not a supplier generated interest. It’s a demand on the part of consumers.”

This creates big challenges for some builders according to Dietzen, because many of them are accustomed to creating a shell for agriculture and sheds; they are not used to dealing with plumbing, all of the mechanical pieces that go into residential builds, and highly finished interiors. Many of them have turned to subcontractors to complete this part of the project.

Keymark has taken this challenge and used it to help expand the post-frame market by enhancing its software to support barndominiums. It’s one of the company’s primary focuses for 2023, along with incorporating supports for all metal building.

Taking advantage of trends is exactly what Beatriz Ceballos, Export Manager and Isocindu advise. They believe that some emergent trends will positively impact the industry, including the push for Green buildings, automatization for efficient building management and new digital technology.

“Some of the sectors will slow down,” she said, “but others such as cold chain will increase and there’s a high demand for material supply chain, labor, etc.”

Both Ceballos and Robert Zabcik, P.E., LEED AP Technical Director for the Metal Construction Association, see great growth potential in IMP use for cold storage niches such as agriculture, seafood, pharmaceutical, and cannabis.

Haddock sees great things for S-5! coming up, expecting significant growth in 2023. Many of the products they produce are related to safety, especially snow retention products and mounting fault protection systems. As well as being part of new construction, these safety items are often part of retrofits, and they are often required for code compliance.

While not life-saving, solar applications are quite popular as people try to bring their energy costs down. Energy costs have soared and the war in Ukraine has not helped. The more it goes up, and as governments offer incentives, the more attractive solar thermal and photovoltaics become.

“When you can install an electric generation system that will last 35 years or more and it pays for itself in the first few, who wouldn’t do that?” Haddock asked.

Energy costs in other parts of the world are generally even higher than in the U.S. and Haddock and company are expanding into new export markets, extending their reach and drawing in revenue sources from all over the world.

Johnston’s viewpoint coincides with Haddock’s belief that solar panels and accessories are a good industry sector to be in currently. He states that revenue will be driven into the residential sector of the industry, referring to the Inflation Reduction Act, in which the government has extended a wide range of tax credits for homeowners who install solar panels and other energy efficient products such as new windows, water heaters, HVAC systems and heat pumps. Of course, contractors can drive business by becoming knowledgable about the potential tax and energy savings, tailoring their offerings and assisting potential customers to qualify for the tax benefits.

Other forms of environmentally friendly products can have an “enormous economic impact,” according to Collins. Manufacturing and/or offering products with great thermal performance, for example, are great options.

“Frankly, there is a lot of money to be made in making products that can contribute to easing the impact of global warming,” Collins said.

The Lumber, Building Material, and Hardlines (LBMH) industry sees promise in investments in software. In line with the construction industry overall, these companies have seen great returns in 2022. With extra capital in their pockets and an expected downturn in the economy, they are in many cases expanding their e-commerce and support for online sales. 88% of those surveyed saw increases in their e-commerce over the last 12 months. The fact that consumers have accepted new e-commerce channels is promising and suggests that while builders may not be able to sell their finished product online, aids such as visualizers may be helpful in this business climate.

Customer Service & Employees

Rios and O’Hara believe that the key to being successful in the new year will be great customer service and ensuring that your company has the supplies they need in stock. Part of that involves pre-planning and communicating with your suppliers sooner rather than later.

Meanwhile, Storer warns that contractors and builders stockpiling materials way ahead of need because of past chain supply challenges are likely to cause more delays for those who need the supplies sooner rather than later.

When it comes to the employee shortage, O’Hara and Rios advise that you take care of your current employees. Managing customer expectations is an important factor in keeping employees from burning out.

ABC’s Construction Confidence Index seems to support that idea. Over half of industry professionals indicated that they believe that staffing levels will remain the same or go down, and when you consider that the staffing levels have been short this year, it’s probably a sign that employers should try to hold on to the employees they have.

Zabcik advises doing whatever you can to retain talent.

“Look to reroof and retrofit to pick up when new construction slows, but try hard not to lay people off,” Zabcik said. “You’ll never get them back.”

Haddock agrees; he doesn’t see the employee shortage going away any time soon. Forward-thinking companies will likely come up with new training techniques to increase efficiency and productivity and possibly reduce turnover, he said. However, he doesn’t see labor costs going down a lot unless construction demand comes down in middle to late 2023.

Dietzen doesn’t see an easy fix to the labor shortage. Like Haddock, he thinks there is opportunity for anyone who can find or develop solutions to help ameliorate the problem, such as automation, new software, any techniques or processes that require less labor or lower the bar on the skill level required.

For those who are struggling to find new employees, Collins advised hiring full- or part-time recruiters to focus on finding employees through various job sites and social media platforms.

Closing Arguments

Johnston offered this insight: “Builders will continue to struggle finding quality workers at affordable wages and will continue to see elevated costs of materials, while projects plateau or decline. Fortunately, we do expect inflation to be lower in 2023 than it was in 2022, and we expect the actions of the Federal Reserve to reduce inflation further as the year progresses, limiting further demand destruction and inflationary trends.”

As far as trends in construction, Haddock has noticed over the last fifty years or so that commercial construction follows residential construction; though it does have roughly a six-month time lag, In other words, if residential construction slows down, commercial construction usually follows suit eventually. When residential starts to pick up, commercial will again follow suit.

Haddock has advice for those in the industry who would like to feel more confident about their prospects for the future. He suggested studying and thinking through the likely prognosis for different aspects of the industry. For example, if you build high-end custom residences that people pay over a million in cash for, they will likely build it even with an economic downturn, and low-cost housing is a necessity. But the $300,000 to $400,000 home buyer is the guy who is being squeezed. “Try morphing your business into a direction that will help protect you,” Haddock said.

Johnston bears out this idea, noting that if there is a silver lining in the construction market, it may be the high-end residential market.

“High earners have not shown a meaningful decline in purchasing power,” Johnston said. “In 2023 we expect high earners to continue investing in residential real estate and for high-end residential construction experts to remain in demand.”

Other industry sectors that Haddock sees as safer and great options to expand a building business into: hospitals, nursing homes, and other medical facilities, and government buildings. These places are necessary and eventually they need to be refurbished if not rebuilt. Agriculture is another example of a more recession-proof sector. “People have to eat,” Haddock says.

Dietzen notes that some business owners start as contractors, grow, and begin buying in bulk, developing a supplier business in addition to contracting or to replace their contracting business.

In conclusion, the name of the game seems to be: diversify. The more sectors you are involved in, the less you will be negatively impacted if one sector sees a downturn. GSCB