The purpose of the Construction Survey Insights (CSI) section in all of our magazines is to provide data in more depth, in an attempt to provide useful information, insights, or observations. Our magazines cover a wide range of market segments but have a significant amount of common ground. This means at times it can be difficult to find statistically significant differences between groups. That could be because our sample size isn’t large enough, similarity between groups, or we are not asking the correct questions in the correct way.

This data may be the result of one or all these issues.

Since a survey is, by definition, self-reporting, it is one of the least reliable measures statistically. However, in our industry it is the only tool available.

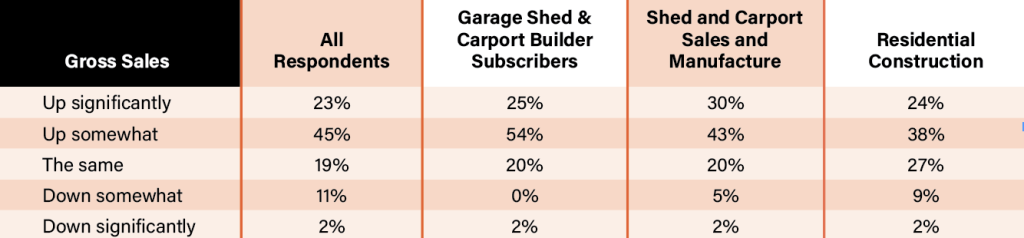

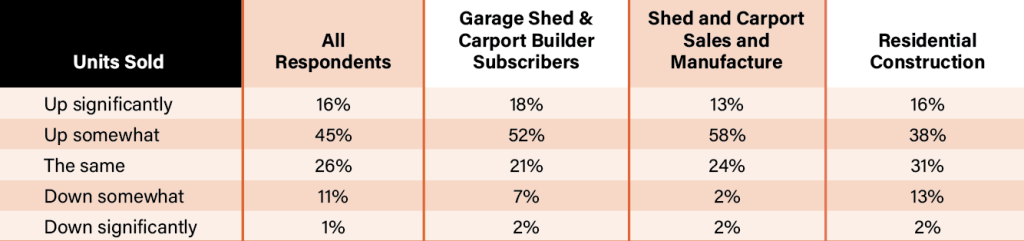

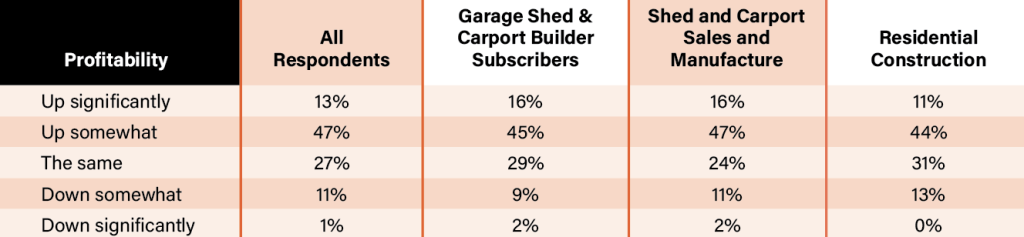

The one difference in our data that stands out is all of the other categories outperformed “Residential Construction”. This is interesting because “GSC Subscribers” and “Shed and Carport Sales and Manufacture” were closer to “All Respondents” than “Residential Construction”. This is significant because Shed and Carport Sales and GSC Subscribers are, by definition, Residential Construction.

Let’s take “Profitability” as an example. Residential “Up Significantly” and “Up Somewhat” totaled 55% in this group. The other categories ranged from 60% to 63%. Residential also had the highest “Stayed the Same” and “Down Somewhat”, but the difference from the other categories was not statistically significant. GSCB