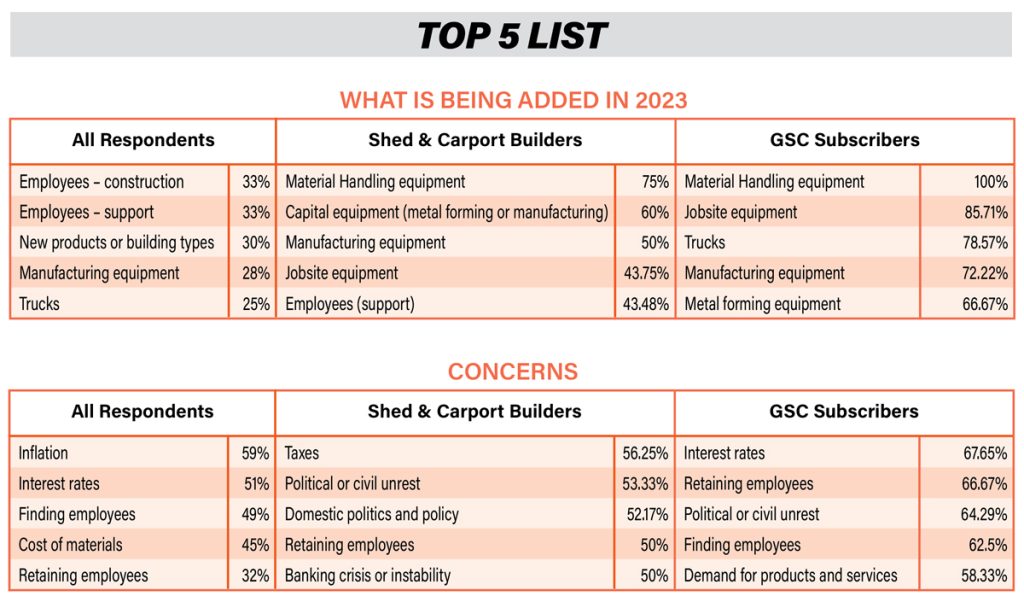

Our Mid-Year Survey included questions about concerns and challenges for the remainder of 2023. Some things remained constant across “All Respondents,” “Shed & Carport Builders,” and “Garage Shed & Carport Subscribers,” but there were some interesting differences.

All groups listed adding Manufacturing Equipment as a Top 5 item. Shed & Carport Builders and GSC Subscribers both listed Material Handling Equipment and Jobsite Equipment as a Top 5, while All respondents had Material Handling at #9 (with 12%) and Jobsite at #6 (with 23%).

Construction Employees didn’t make the Top 5 for either Shed & Carport Builders or GSC Subscribers. But the percentage of respondents adding them for both categories were still higher than All Respondents. All respondents had both Construction and Support Personnel added at 33%. Shed & Carport Builders had Construction (41%) and Support (43%) and GSC Subscribers had Construction (65%) and Support (60%)

For challenges, the only Top concern spanning all groups was Retaining Employees. Both Shed & Carport Builders and GSC Subscribers listed Political Instability in the top 5, for All respondents it was at #13 with 22%.

While Interest Rates did not crack the Top 5 for Shed & Carport Builders it was a significant concern as reported at 47%. One other difference not demonstrated well in the Top 5 is the concern surrounding Demand for Product. GSC Subscribers had is as a Top 5. For Shed & Carport Builders it was at #12, but still at 42%. The concern for Demand among All Respondents was at 18%.

One interesting and seemingly contradictory observation is that Shed & Carport Builders and GSC Subscribers had both higher percentages associated with adding new products and services and higher percentages listing concerns, so an interesting mix of apprehension and optimism. GSCB