By Linda Schmid

The new year is underway and business is humming along, but what is your plan for the year? For creating or revisiting your plan, it may be beneficial to review the state of the economy and where it seems to be headed. Let’s start by seeing what the economists have to say.

From The Economists

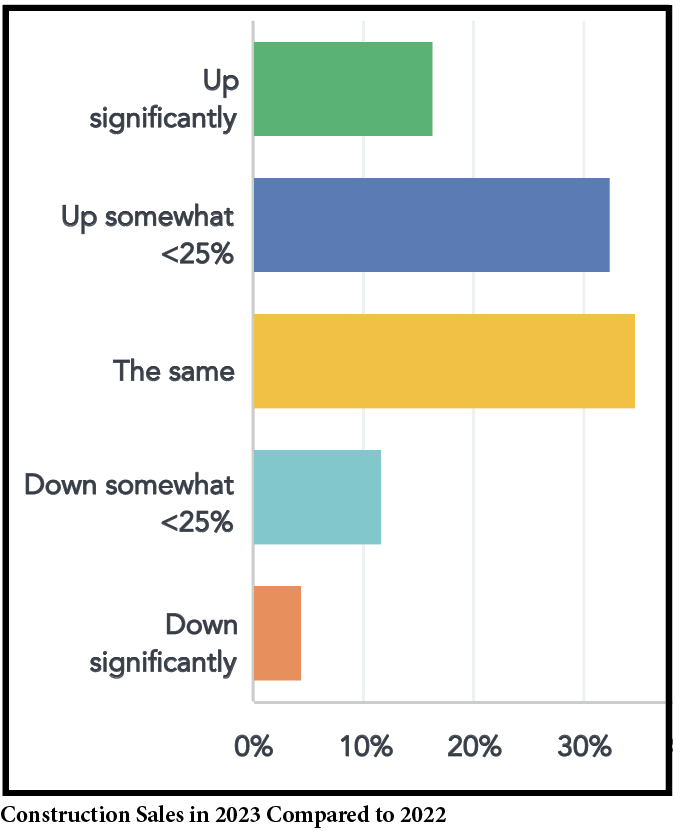

Ken Simonson, Economist at the Associated General Contractors of America, said that after a torrid third quarter in 2023, he sees growth ahead, but slower growth and job creation are likely in 2024.

“I expect a modest reduction in the inflation rate,” Simonson said, “though not enough to get down to the 2% range the Fed wants to see before lowering its short-term interest rate target.”

He expects both short and long-term interest rates to stay where they are or move higher.

Anirban Basu saw many positive indicators in the state of the industry as 2023 was coming to a close, as well as some reasons for concern.

The positives include the job market which remained strong, people were returning to offices, inputs to the Producer Price Index for construction were down considerably from pandemic levels, multi-family residential permits were above average, single family permit numbers were back up to pre-pandemic levels, and the construction backlog remained strong.

Some of Basu’s concerns include credit card debt which has been moving steadily upward. (At the end of the third quarter of 2023, it stood at $1.079 trillion.) High borrowing costs and inflation are also red flags for Basu.

“Even amid this growth,” Basu said, “it’s prudent to remain wary.”

Insiders Report

“Many of our customers are optimistic for a better 2024 than 2023,” Scott Lowe, Roofing Sales Director at ProVia said. “I feel like we slowed down a bit in the last quarter of 2023 and I am curious to see if that will carry over into the first quarter of 2024.”

Steve Swaney, Account Manager at Mid-South Aluminum, said that they are expecting sales will be up a bit as metal prices fall and demand picks up.

“Coil rebounded nicely in 2023,” said Steve Rutkowski, PPG coil senior manager, Americas, “and we expect positive growth this year.”

However, Shannon Latham, the Shed Geek at Shed Geek Podcast.com, believes that sales will be fairly flat while profitability may be up due to higher price tags.

Swaney believes that the agricultural building market should do well in 2024 since the price of food is up.

“I think remodeling and renovation will go through another stronger period the 2nd half of 2024,” Swaney added, “as people decide to stay in their homes, or people that moved into a new home during COVID do some more upgrades and personalization.”

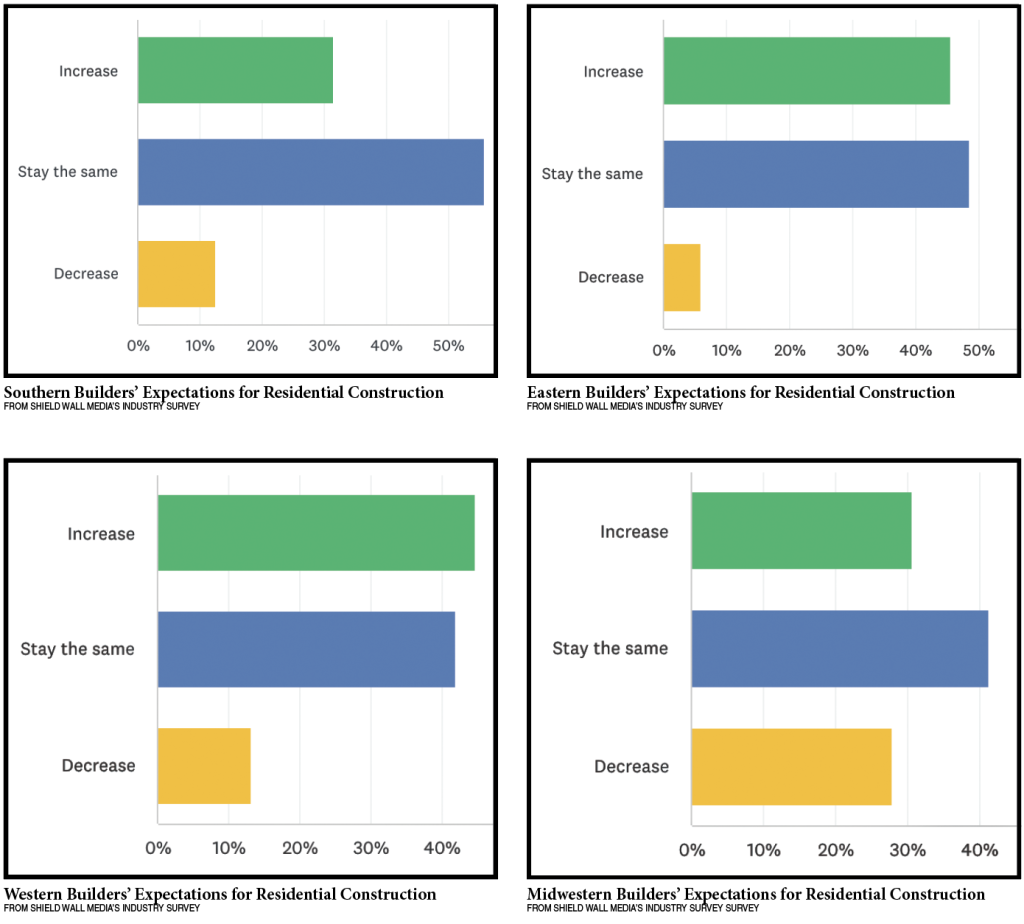

Gabriel Schlabach, Manager at LuxGuard, believes the construction industry overall could be flat to slightly down. However, he adds that it’s hard to say; the economy doesn’t act “normally” any more, not since the pandemic years. This seems reminiscent of something Basu said about the economy and the construction industry, it all seems to just keep going regardless of warning signs to the contrary.

The industry overall has been successful through labor shortages, high interest rates, high material costs … whatever obstacles have been put in its way. Will that continue though?

“During COVID people overspent and we are seeing the results of that now,” Schlabach said. He is referring to the fact that many people purchased sheds at that time, so fewer people are buying them now. “However,” he added, “if spending remains loose and people have cash, they will keep buying sheds.”

The Industry’s Greatest Challenges

Rutkowski agrees. “Interest rates are a challenge as they impact spending, especially in building and construction. We saw a boom in remodeling and upgrades during COVID. However, this year, less discretionary income and concern about interest rates could dampen growth in the industry, but we are cautiously optimistic.

“Inflation is no doubt the largest issue looming over the industry,” James Alpeter, Marketing Manager of Siding, Stone, and Roofing at ProVia said. “I think many homeowners are trying to hold off on large purchases in the hopes that inflation will slow or fall.” Of the various markets, Alpeter said that the residential market is the toughest one to forecast.

“I think that builders are cautiously optimistic and expecting growth, but at the same time preparing for a flat result,” he continued.

Lowe added that inflation and interest rates are the two biggest concerns that their customers talk about.

Latham believes that in a maturing industry, like the shed market, making the sale is the biggest challenge. “In a conservative industry that doesn’t tend to embrace new ideas, those taking advantage of new marketing sales technology, such as 3-D configurators and SEO optimized websites, will take a larger market share in their region,” he said.

Latham is also concerned about the economic unrest that tends to occur in election years and how it affects purchasing decisions

“Labor is a big concern; many trades are shrinking in number and skilled labor is getting ever harder to find,” Alpeter said.

Swaney added that Gen Z does not want to do physical labor, meanwhile the older tradesmen are retiring.

Latham agreed that it seems that today’s kids don’t want to work hard. Maybe we are setting them up to expect everything to be easy, he said. On the other hand, many of the jobs offered to them are subcontractor jobs, so they don’t have health insurance, taxes aren’t handled for them, and they have no benefits.

“Often these people will just move on to a better job,” Latham said. “Perhaps making subcontractors into W2 employees, giving them workers comp, benefits, and giving them a chance to build a career would help the industry.

“If you are not investing for the long term, you are creating a rotating door,” Latham said. GSCB

To read more articles from the Feb/Mar edition, click here.